International Students in Canada: How to Distribute the Budget

Canada has long been the top destination for overseas students seeking an education. The reason is the diversity of courses offered by Canadian colleges and universities. Even if moving to a new nation and the prospect of a wealthy future may seem alluring, it is not without difficulties. These young people probably leave their homes for the first time when they come to Canada to study.

Consequently, they have a tough time managing things, especially financially. Students often encounter challenges, including living alone, studying, and thriving in brand-new social situations. These challenges are exacerbated for international students since they are not only away from home but also studying abroad. Additionally, managing your funds may be challenging.

What Exactly is a Budget?

A budget is a strategy for setting up your finances by taking into account the anticipated income and spending for a certain period. It involves keeping track of how much money you have coming in compared to how much is going out and setting aside some money for unanticipated costs.

When you budget as an international student, you can:

Become informed

It gives you perspective on your spending habits and tendencies, helping you cut down on unnecessary costs.

Observe and record

It assists you in maintaining control over your funds and acts as a roadmap for achieving financial independence.

Getting ready for the future

It guarantees that you have a strategy in place to cover any unanticipated occurrences, significant purchases, or life events.

Tips for International Students on Budgeting in Canada

You must constantly budget as an international student to avoid exceeding your spending limit. Making a budget is a terrific method to manage your finances and save money.

Here is some financial advice for international students studying in Canada:

Keep an eye on your finances

Create a precise budget and establish saving objectives.

Recognize the distinction between desires and necessities

You don't need to spend money on new clothing every month; stop buying things you can do without. Spend your money on things you need instead of something you just desire.

Make a list of your earnings and outgoing costs

Set aside the funds you want to use for food, rent, transportation, and clothing. Avoid going overboard with your expenditures and stick to your budget.

Look for ways to make money

You may work as a freelance writer, market researcher, social media manager, instruct online students, or blogger.

Additionally, you have to set aside cash for escapism, amusement, and emergencies. Keeping track of your finances can help you avoid overspending and searching for a loan agreement template while studying abroad.

How Can Canadian International Students Save Money?

You may live independently in Canada regardless of the expensive living costs if you know how to manage your money. We often attempt to reduce our spending and save money, but the key is to manage our money carefully. A few of them are:

Utilize Student Discounts

Several student discounts are included with your student ID card. It may consist of discounts on meals and transportation, attractions, and shopping promotions. Though not all establishments make this clear, they most certainly do. Bring your student ID card with you everywhere you go, and before making a purchase, check to see whether they accept student IDs.

Even while it can start tiny, it can eventually build up to a sizable sum. You might save anywhere from C$15 to C$60 if certain attractions are free for students. You must personally verify this with the business since it relies totally on the attraction.

Having Roommates May Help You Save Money

Rent, utilities, and food costs for a single apartment might be rather high. You may spend anything from C$800 to C$1,500 or more, without counting utilities, depending on where you want to study and the kind of residence you choose.

On a budget, living with other students is perfect for distributing extra expenses equally. It will help you not only financially, but you will be able to find friends.

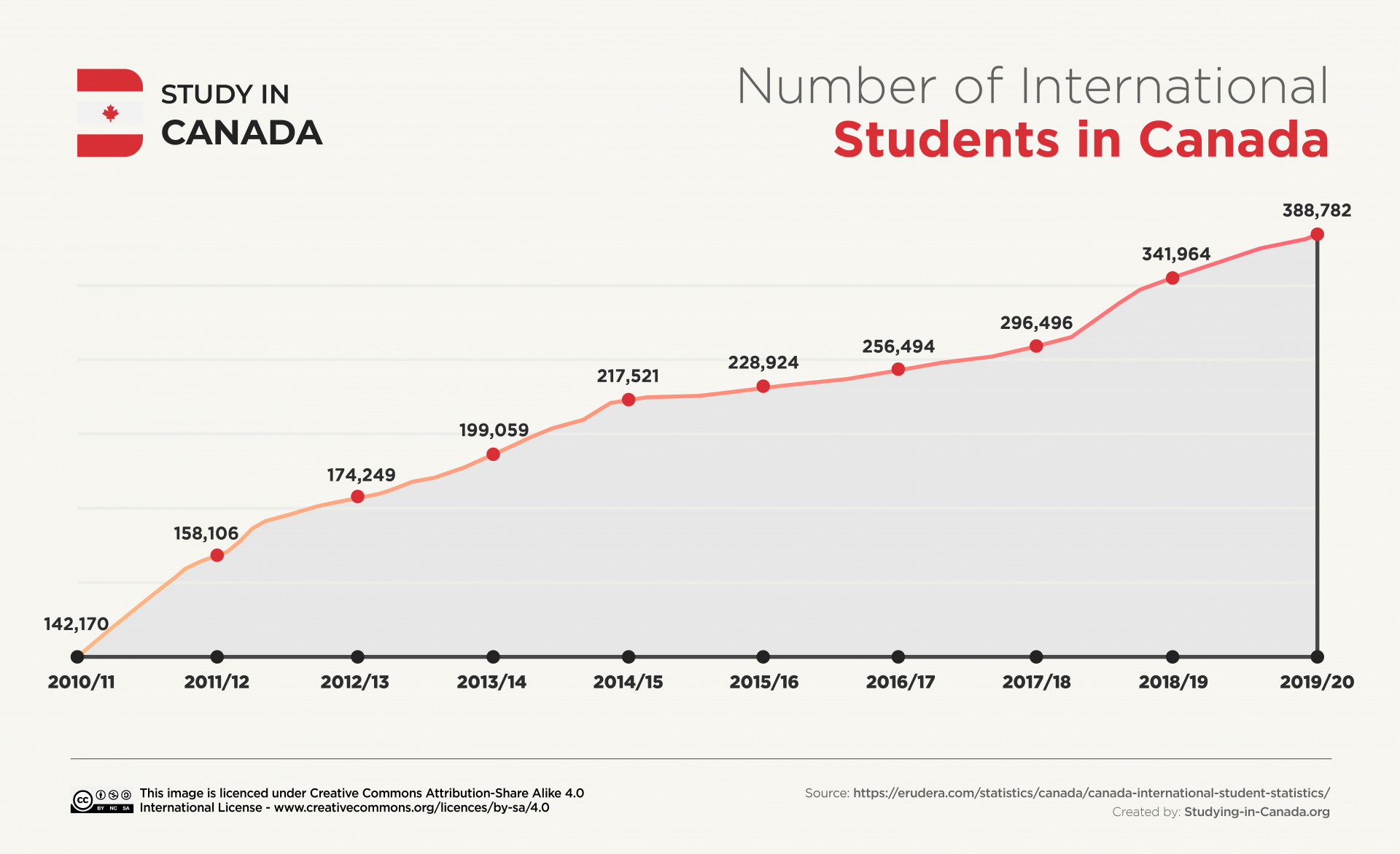

Over the past 10 years, the number of international students in Canada has increased to 388,782 in 2019/2020 and continues to increase yearly. Living with international students or Canadians, you can learn about savings tips or make new and true friends.

You may search for a shared home on social media if you don't have any friends. Rent is a significant investment for any student, so sharing housing with a few roommates is a decent idea to start with. That is how an overseas student first saves money in Canada.

Think About The Exchange Rate

As an international student, knowing the currency rate is crucial to creating a budget. If you don't know this information, your spending may wind up being far more than you intended. Be cautious when estimating the cost of certain things, and keep in mind that in North America, taxes are not shown on price tags.

Several changes to the currency rate could occur while you are studying abroad. It's crucial to periodically review it to ensure you are fully aware of your expenditures.

Working Part-Time in Canada

By doing part-time jobs, international students may considerably lower their living costs in Canada. There are occupations for students on campus. You are also eligible to apply for an off-campus job permit after six months of study. Students from abroad who have visas are allowed to work 20 hours per week in part-time occupations in Canada.

Conclusion

However, always keep in mind that although conserving money is vital, it is equally crucial to sometimes unwind or enjoy yourself. Maintaining a healthy balance between your desire for worldly pleasures and your need to save money is important. Students who work full-time run the risk of burning out quickly.

Instead, spend money each month for fun activities like a night out with friends or a bigger excursion. While there are many methods for international students to save money in Canada, doing so shouldn't get in the way of enjoying life.